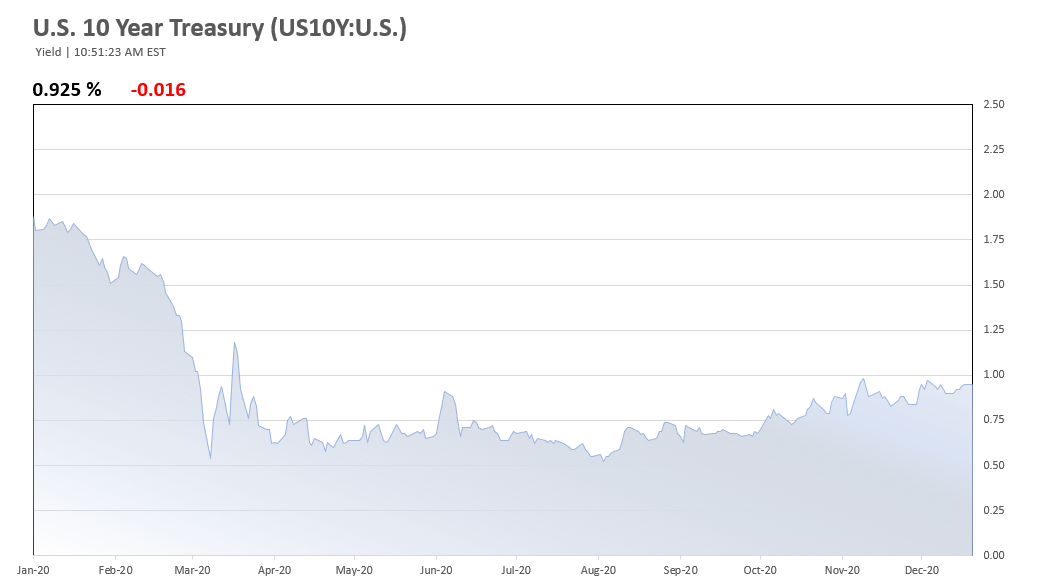

The COVID-19 pandemic continues to be the chief impetus behind this steady low interest rate environment. Not even a $900 billion COVID-19 relief aid bill passed by Congress late Monday is making a dent. News earlier this week of a more contagious virus strain coming out of the U.K. had investors seeking safer Treasury assets pushing the US 10 Yr below 0.90%. So far in Q4 2020, the yield on the US 10 Yr has traded within a tight 30 basis points between 0.68% and 0.98%, while MBS spreads have widened and tightened in response to these slight fluctuations, keeping interest rate pricing relatively flat.

Interest rates on FHA commercial loans continue to be around the same levels since our last update in late August. Expect interest rates to hang around these levels as long as the COVID-19 pandemic continues to play. Check out today's rates.

FHA Commercial Loan Rate Update – December 22, 2020

- 35-year fixed FHA perm loans: 2.15%-2.40%

- 40-year fixed FHA construction/perm loans: 2.90%-3.15%

These pricing indications are current as of the date posted, subject to market interest rate volatility. Pricing of FHA insured apartment and healthcare loans may be dependent on loan size and other risk factors. Call for more information.

Interested in learning more about FHA's attractive 223(f) refinance loan program?

Click to learn more!