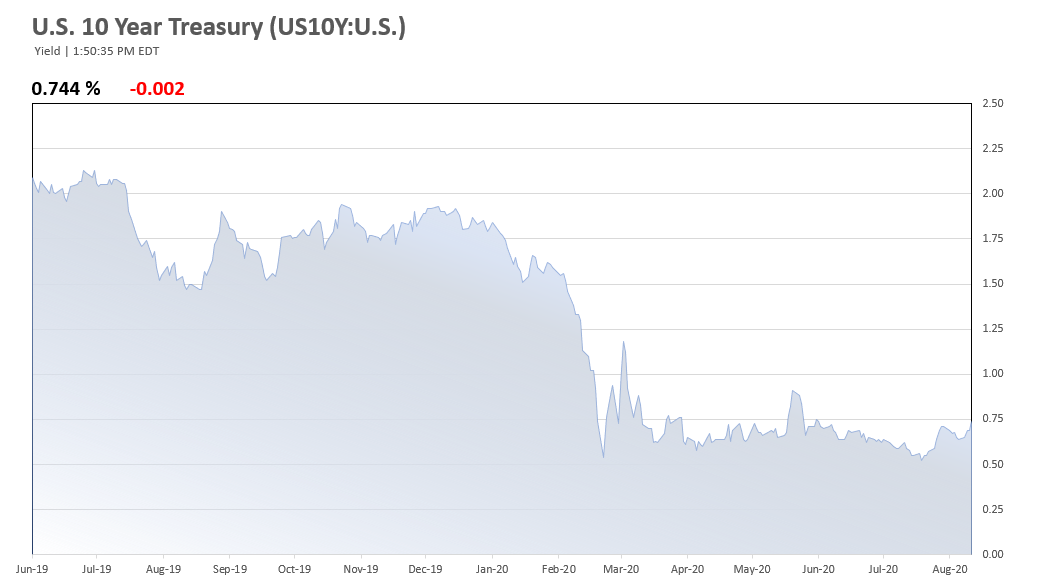

Fed Chairman Jerome Powell announced yesterday a shift in the Fed’s inflation policy that will delay future rate increases and extend this low interest rate environment. The Fed will now target an average inflation rate of 2%, allowing for the inflation rate to exceed 2% before considering a lift in interest rates. Previously, the Fed looked to keep the inflation rate at or just below 2%, and indications of surpassing such threshold were met with interest rate increases intended to cool the economy and rein in inflation. Between 2015 and 2018, the Fed raised rates nine times as the inflation rate crept above 2%. The Fed may now be content with an inflation rate in the range of 2.25%-2.50%, noted Dallas Fed President Robert Kaplan in an interview with CNBC. This policy change will keep interest rates down longer.

With rates expected to stay low, MBS spreads to the US 10 Yr have tightened, and Ginnie Mae MBS investors have lowered the interest rate floor. Check out today’s improved rates.

FHA Commercial Loan Rate Update – August 28, 2020

- 35-year fixed FHA perm loans: 2.15%-2.40%

- 40-year fixed FHA construction/perm loans: 2.90%-3.15%

These pricing indications are current as of the date posted, subject to market interest rate volatility. Pricing of FHA insured apartment and healthcare loans may be dependent on loan size and other risk factors. Call for more information.

Interested in learning more about FHA's attractive 223(f) refinance loan program?

Click to learn more!