Inflation remains stubbornly high. The U.S. CPI was up 0.5% in January 2023 and 6.4% over the previous 12-month period. "The latest economic data have come in stronger than expected, which suggested that the ultimate level of interest rates is likely to be higher than previously anticipated," said Fed Chair Jerome Powell in his address to the Senate Banking, Housing and Urban Affairs Committee on Capitol Hill earlier this week. The market is now pricing in a 0.50% rate hike in the upcoming FOMC meetings later this month.

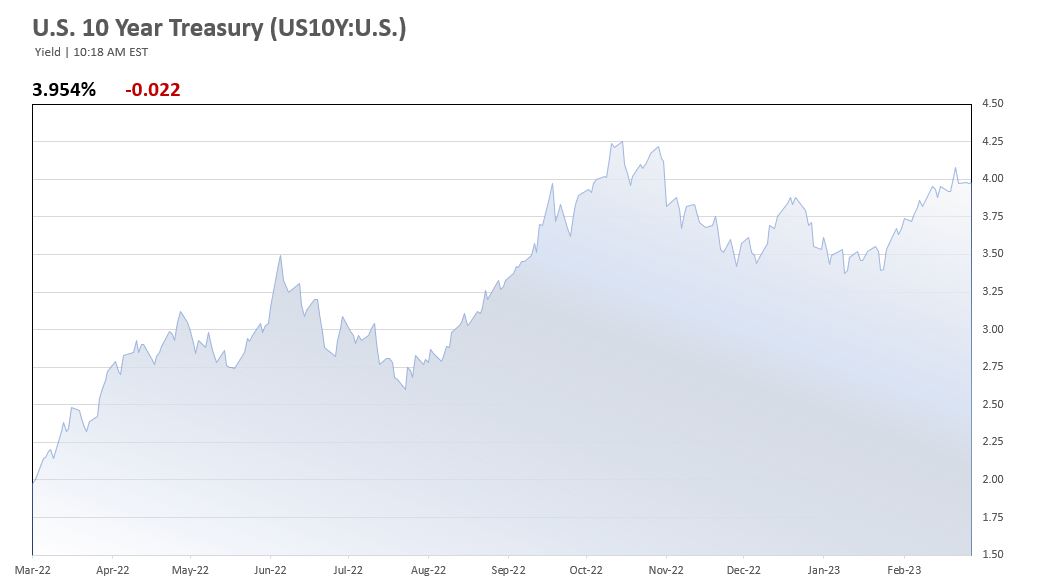

The average rate on the popular 30-year fixed mortgage is up to 6.875%. The yield on the US 10 Yr is now hovering around 3.95%, approximately 200 basis points higher than 12 months ago. HUD commercial interest rates have settled in the 5.00%-6.00% range over the past 3 months. Check out today’s rates.

HUD Commercial Loan Rate Update – March 9, 2023

- 35-year fixed FHA perm loans: 5.20%-5.50%

- 40-year fixed FHA construction/perm loans: 5.70%-6.00%

These pricing indications are current as of the date posted, subject to market interest rate volatility. Pricing of FHA insured apartment and healthcare loans may be dependent on loan size and other risk factors. Call for more information.

Interested in learning more about FHA's attractive loan programs?

Click to learn more!